Tailored and Confidential Financial Guidance

2333 Brickell Ave st 1D, Miami, FL, 33129 | +1 (305) 289 8210

Tamarindos 400-A P21 Bosques, CDMX, 05120 | +52 55 98160270

Portfolio Investments

VFS Ventures team will provide efficient, cost-effective and transparent service to manage your assets and your wealth under absolute privacy. Our strict code of ethics combined with our potent analytic process offers a distinctive investment management service. Our clients benefits from proprietary and cutting-edge technology providing outstanding ROI with absolute transparency.

Financial Planning

Literate in Data, Finance and Economics, VFS Ventures' team will provide fresh, informed and structured view of the context and alternatives for you to choose the optimal decision. Our team is trained to find the highest shareholder value in every context. We do not replace your experts, although we provide a fresh and cutting edge view and structured solution to amplify your net benefits.

Valuation

VFS Ventures cumulative experience and technical capabilities will provide outstanding service for Valuation. Fluent in Data, Finance and Economics our team would be capable to front-face any Negotiation with the technical strength in your favor. VFS Ventures may also serve as arbitrator to solve private and judicial disputes, in collaboration with authorities when required

Macroeconomics

Accurate macroeconomic forecasting is essential for business decisions, financial trading and as a basis for policy decisions by politicians, economists and business persons.

VFS Ventures' experienced economists are available on a consultancy basis to address your specific needs. We produce robust economic analysis, insight and research to help your organization to achieve optimally informed decisions.

US Softlanding Services

The legal structure of any startup is the foundation on which an enterprise is built, so choosing a structure that best suits the new business is essential to its success. The Business Startup Practice at VFS offers a wealth of experience to domestic and international clients with interests in the United States, offshore and abroad.Through strategic alliances with expert and sounded attorneys in New York, our Business Startup proffesionals work with entrepreneurs, directors and officers on the following matters:- Articles of Incorporation

- Partnership Agreements

- S Corporation Establishment

- LLC and LLP Formation

- Shareholder Agreements

- Asset and Stock Purchase AgreementsFor international clients seeking to establish a business in the United States, we offer a complete range of U.S. entity formation services. For clients conducting business abroad, our Business Startup Practice works with the Firm’s affiliated international counsel to provide service and advice that is current and informed.

Contact us

Investment Process

Setting your goals: We help in establishing our goals to provide structure and purpose for your investments. Goals can help you meet major life objectives, such as retirement or face child's higher educationDetermining risk tolerance: We asssit in measure of how much risk you are willing to take on, in exchange for potential higher returns.Asset allocation and Diversification: With the above, we assist in how to choose from different investments and allocate a portion of the budget into each. This involves investing in a variety of assets, such as stocks, bonds, and cash with several objectives including mitigating risk.Monitoring and adjusting:

This involves tracking your portfolio's progress, key metrics, and milestones to sugest and make adjustments as needed.

Asset Allocation

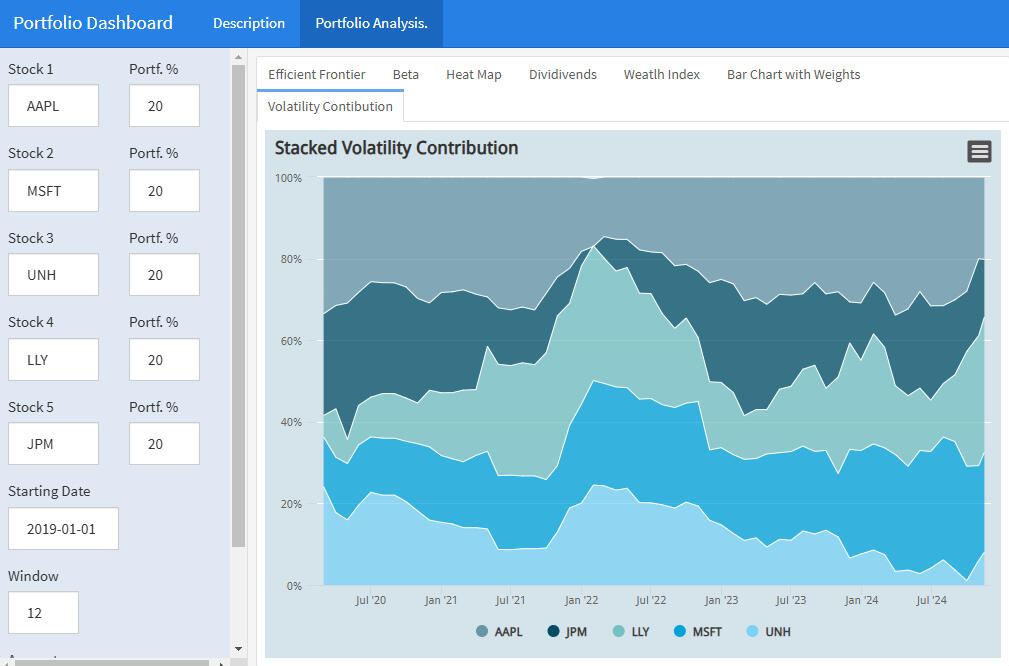

Here is propietary app where you can test part of our methodology for asset allocation. On the following app you can:

- Calculate asset evaluation of risk and return and produce and display the Eficient Frontier

- Calculate asset sensitivity to the market to produce and display each Asset's Beta

- Comparatively evaluate asset's performance in terms of its Fundamental Ratios

- Calculate asset's Dividend Yield and compare its perfomance with other assets

- Calculate past returns and produce and display a Wealth Index for certain invested ammount for certain date

- Considering user's selected allocation and display asset's risk contribution and comparison with its wight in the portfolio

- Considering user's selected allocation, display time-weighted asset's volatility contribution to the portfolio

The Wealth Gap and The Obsolescense of Humans

Leonardo ZepedaWhat if the stories we tell ourselves about wealth in America aren't quite accurate?We've heard it countless times: work hard, innovate, build something valuable, and you'll earn your fortune. But what happens when we examine the actual numbers behind these narratives?Consider what the data reveals about our emerging two-tier society.In the first quarter of 2024, the top 10% of Americans controlled 67% of total wealth. The bottom half of all workers? They owned just 2.5%.If you're among the fortunate 10%, you're essentially living in a different economic reality. Like the pristine space station in Elysium, your world operates by different rules, with access to opportunities that compound exponentially.But there's another pattern worth examining from your elevated position.While typical worker compensation grew 24% from 1978 to 2023, CEO pay increased by 1,085% over the same period. From your vantage point at the top, can you see how the distance between the space station and Earth keeps expanding?Perhaps most revealing, research shows that 60 percent of billionaire wealth now comes from inheritance, monopoly power, or crony connections rather than entrepreneurship.If you've inherited your place on the station or built it through strategic positioning, how does it feel to watch others believe they can still build rockets from the ground?Now consider how recent policy shifts might fortify your orbital advantage.The wave of protectionist policies gaining momentum promises to reshape global trade dynamics. For those already positioned in the space station of wealth, could these measures create an even more exclusive environment?Think about it from your protected perch: when tariffs shield your industries, when trade barriers eliminate competition, your profit margins expand while those below pay higher prices for basic goods.If you're among the asset holders floating above the economic turbulence, the outlook appears remarkably bright. Protected markets, reduced competitive pressure, expanded margins—it's like upgrading your space station's defenses.But what about the view from your window?While your portfolio values surge and protected industries flourish, can you see the families below whose purchasing power erodes as prices rise? When domestic production costs increase due to limited competition, they're the ones absorbing those expenses on the polluted Earth below.The same policies that enhance your orbital lifestyle might simultaneously squeeze the very workers they claim to protect. Higher costs of goods, reduced choices, wages that can't keep pace with the rising cost of reaching your level.From your position of advantage, are you witnessing the creation of a permanent separation? Where policy itself becomes the force field that keeps the space station secure and the ground level contained?Perhaps the most pressing question from your elevated perspective:As the distance between the station and the surface grows, what kind of society are we creating? One where your orbital advantage becomes increasingly permanent, or one where others might still find a way to join you among the stars?The view from Elysium is certainly spectacular.Here's what should keep you awake in your orbital paradise:Artificial intelligence is about to make everything we've witnessed look quaint. The same technology that could solve humanity's greatest challenges will likely flow first to those who already own the computational power, the data, and the capital to deploy it. While you gain access to AI that multiplies your capabilities exponentially, millions below will watch their jobs, their relevance, their hope disappear into algorithms they'll never understand or control. The gap we're measuring today in mere percentages will become a chasm measured in different species of human capability. You have the power to choose whether AI becomes the ultimate force field around your space station, or the bridge that finally connects our worlds. The children growing up in the shadows of your wealth won't just inherit economic inequality—they'll inherit a planet where their very humanity feels obsolete. Your wealth gives you more than comfort and security; it gives you the responsibility to ensure that our species survives this transformation together. Because no space station, no matter how pristine, can sustain itself forever when the planet below becomes uninhabitable—economically, socially, and spiritually. The choice is yours, but the window is closing fast.

Your advisor should warn you when your portfolio might bleed

Leonardo ZepedaPicture this nightmare: You've just discovered that your "successful" $2 million portfolio has been hemorrhaging $23,000 annually to taxes you never saw coming. Your advisor—the one you trusted with your financial future—never mentioned it once.This isn't a hypothetical horror story. It's happening right now to investors who think they're winning.The math is devastating. Tax costs average 1.14% annually while portfolio fees average just 0.38%. You're bleeding three times more to taxes than to the fees you obsess over.Here's the gut punch: Your investment advisor won't get fired for picking a stock that crashes 20%. They get fired for failing to warn you about tax consequences that could destroy decades of wealth building.Most investors discover this betrayal only after watching years of gains vanish into the tax void. Don't let this be your story.The Real Job of Investment AdvisorsInvestment advisors aren't accountants. They don't need to master every twist in the tax code or track regulatory changes across multiple jurisdictions.But they absolutely must understand your tax context before recommending any investment structure.Your advisor's primary responsibility is preventing uncertainty. Tax uncertainty ranks among the biggest risks you face when building wealth.This requires constant collaboration with accountants to understand how profits and redemptions will be taxed when you monetize investments. The critical question your advisor should ask your accountant: "How will this investment be taxed when my client exits?"Here's what should terrify you: Most advisors focus on the asset's characteristics while completely ignoring your personal context. They're essentially flying blind with your financial future as collateral damage.Your Personal Context Changes Everything. Your investment's tax efficiency can collapse overnight based on changes in your residence, marital status, or age. What works perfectly today might create disproportional tax consequences tomorrow.Imagine this scenario: You get divorced, remarry, or move to a different state for a dream job. Suddenly, your "tax-efficient" portfolio becomes a financial landmine. The complexity multiplies when you consider two separate variables: the residence of your assets and your own residence. When these differ, you face potential changes in local tax codes amplified by exchange rate fluctuations.The stakes get higher: Your investments may face restrictions or withholdings that don't just eat your profits—they can seize part of your principal. Your nest egg literally shrinks while you sleep.The equation becomes exponentially more complex when your residence changes or becomes disputable. And then there are the digital nomads—creating a perfect storm of tax chaos.Digital Nomads Break Traditional Tax PlanningDigital nomads represent a nightmare scenario where traditional tax planning completely breaks down. When your tax residence is genuinely unclear, standard investment structures can create compliance disasters.The numbers are terrifying. Research shows 79% of digital nomad visas provide no individual tax relief, while 85% offer no corporate tax exemptions.Picture this catastrophe: You're spending four months each in three different countries, living your best life, while three different tax authorities are quietly building cases to claim your entire portfolio. Your investment structure—designed for a single jurisdiction—becomes a weapon pointed at your own wealth.This complexity demands a new approach: wealth engineering.Wealth EngineeringWealth engineering means architecting financial structures that serve multiple masters simultaneously: you, your business partners, and various tax authorities.Consider a family office facing multiple challenges: the family head transitioning between jurisdictions while optimizing their preferred residence, children trapped by different residence statuses, and assets spread across multiple countries.The stakes couldn't be higher: One wrong move could trigger a cascade of tax consequences that wipe out generations of wealth building. The solution requires surgical precision in selecting assets that minimize potential withholdings and unexpected tax contingencies. You need investment vehicles that confine risks while optimizing returns for all stakeholders.But here's the catch that keeps wealthy families awake at night: wealth engineering creates a fundamental trade-off that could make or break your financial legacy.The Complexity Trade-OffWhat you gain in tax efficiency often comes with substantial administrative burden. More complex structures require deeper trust in your advisory and management teams.Here's the terrifying reality: You can engineer the perfect tax structure, but if it requires a small army to manage, you're one key person away from financial disaster. What happens when your trusted advisor retires? Gets sick? Changes firms?The breaking point is personal: The threshold where complexity becomes justified depends on what professionals call "the size of the load." When your portfolio reaches sufficient scale, administrative burden becomes worthwhile not just for tax savings but for survival-level diversification benefits.Spreading assets across different structures and jurisdictions provides risk mitigation that goes beyond tax optimization.The New Threshold Reality. The minimum portfolio size that justifies sophisticated wealth engineering has dropped dramatically. Recent regulatory changes and increased tax authority scrutiny have lowered the bar.This changes everything: A $10 million threshold now represents the appropriate entry point for complex structures. This represents a significant decrease from historical minimums as regulatory uncertainty makes professional tax planning a matter of financial survival, not optimization.If you're sitting on $10 million or more and haven't addressed this, you're essentially gambling with your family's future.Family offices with $1 billion in assets typically spend $6-10 million annually on operating costs, but the proportional benefits begin appearing at much lower asset levels.The math works because tax planning creates compounding benefits over time.Professional Guidance Matters More Than EverTax-efficient investing requires understanding how different strategies perform across market conditions. The timing difference between short-term and long-term capital gains creates a 17 percentage point penalty that can devastate returns.The penalty is crushing: Short-term gains face federal rates up to 40.8%, while long-term gains cap at 23.8%. That's nearly half your gains vanishing into government coffers. Professional timing strategies can capture enormous value in after-tax returns—or watch helplessly as poor timing destroys decades of wealth building.Here's what should keep you up at night: Your advisor must integrate tax considerations into broader investment strategies, recognizing that after-tax returns matter more than gross performance. If they're not doing this, they're gambling with your retirement, your children's education, your family's security.The collaboration between advisors and accountants happens behind the scenes, but it determines whether your wealth grows or gets consumed by avoidable tax consequences.Regulatory environments continue tightening globally. OECD's BEPS 2.0 targets digital nomads with a 15% global minimum tax starting in 2025. Traditional tax planning strategies face increasing scrutiny.The noose is tightening: Sophisticated investors need advisors who understand these evolving challenges and can engineer structures that remain compliant across multiple jurisdictions. The alternative is watching regulatory changes systematically dismantle your wealth.This is your wake-up call: The value of professional guidance compounds as complexity increases. Your advisor's ability to prevent tax uncertainty has become more valuable than their ability to pick winning investments. In today's environment, tax planning isn't optimization—it's wealth preservation against systematic government seizure.Wealth engineering represents the evolution of investment advice from simple asset selection to financial warfare against multiple tax authorities across jurisdictions.Your choice is stark: Find advisors who understand this new reality and can engineer solutions that protect your wealth from the hidden costs destroying returns—or watch decades of careful wealth building evaporate through tax negligence.The clock is ticking. The regulatory environment is tightening. Your wealth is more vulnerable today than it was yesterday.What will you do about it?

Investment Advisors Often Ask Wrong Questions

Leonardo ZepedaMost investment advisors pride themselves on sophisticated portfolio construction. They have been trained to run Monte Carlo simulations, optimize asset allocation models, and debate the merits of growth versus value investing.However, often they're solving the wrong problem entirely. What their clients are really asking is for a more human interaction.While most advisors are train to focus on mathematical perfection, they miss the human reality that will determine whether their carefully crafted portfolios actually work. The standard intake process captures age, income, and risk tolerance. Then advisors jump straight to asset allocation.What about the 40% chance of divorce? The spouse's unstable career? The aging parent who might need financial support?These aren't edge cases. They're the primary drivers of investment success or failure.The Structure ProblemMost advisors ask "Should we buy stocks or bonds?" when the real question is "Should these assets sit in a trust, a company, or personal name?"Investment structure comes before portfolio design. Always.Consider a professional facing potential liability lawsuits. A perfectly optimized portfolio sitting in their personal name becomes a target for creditors. The technical brilliance of the asset allocation becomes irrelevant when the entire portfolio gets seized.Or take a couple with shaky marriage prospects. Assets locked in joint accounts or illiquid investments create restrictions precisely when flexibility matters most. Life events reshape financial needs faster than any market correction.The wrong structure turns sound investments into disasters.The Adaptability Trade-offTraditional portfolio theory optimizes for returns while inadvertently destroying adaptability. Advisors recommend ten-year investment horizons with assets that can't be liquidated without massive penalties.Then life happens.Job loss, career change, family crisis, health emergency. Suddenly that optimized return profile matters far less than having accessible capital. But the portfolio structure makes adaptation impossible without devastating financial consequences.We're optimizing for the wrong variable. Adaptability often trumps optimization.The Three-Bucket FrameworkSmart financial planning requires three distinct buckets, each with different purposes and structures.Planned events bucket: Traditional investment products work here. Retirement, education funding, known future expenses. These have predictable timelines and can handle market volatility.Insurable unfortunate events bucket: Insurance products address disability, death, property damage. Clear coverage for specific risks with known solutions.Uninsurable unfortunate events bucket: This is where most advisors fail completely. Divorce, professional liability, family financial crises, career disruption. Insurance can't cover these risks, but they're highly probable over any meaningful time horizon.How much money belongs in that third bucket? It depends entirely on individual risk factors, disposable wealth, and projected income. But most advisors never even acknowledge this bucket exists.The Uncomfortable QuestionsEffective financial planning requires uncomfortable conversations. What's the realistic probability of divorce? How stable is your industry? Could professional liability destroy your career? Might aging relatives need financial support?Most advisors avoid these discussions. They'd rather debate market projections than divorce probabilities.This avoidance creates a fundamental service gap. 36% of Millennial investors plan to switch advisory firms, largely because current advisors fail to address their actual needs versus theoretical optimization.The failure becomes obvious at the worst possible moment. When the unfortunate event has already happened and costs are imminent.The Competitive AdvantageAdvisors willing to ask hard questions and structure investments around human reality have massive competitive advantages. They provide actual value instead of theoretical optimization.This requires a communication strategy that introduces uncomfortable topics gradually. Address the most probable risks in early meetings. Save deeper personal vulnerabilities for quarterly reviews after trust develops.The key insight: investment advice must account for idiosyncratic risks around each investor. Market risk and credit risk get plenty of attention. Personal context risk gets ignored despite being more predictable and often more devastating.Beyond the NumbersWe need investment advisory that starts with human reality and works backward to portfolio construction. Not the reverse.This means understanding career trajectories, family dynamics, health considerations, and personal vulnerabilities before discussing asset allocation. It means designing investment structures that preserve adaptability even when that reduces theoretical returns.Most importantly, it means asking uncomfortable but unavoidable questions about probable future challenges. Because the cost of avoiding these conversations always gets paid later, usually at the worst possible time.The math matters. But the human context matters more.

Location?

Leonardo ZepedaRecently there has been a considerable business and policy concerns regarding high vacancy rates of office and commercial spaces in urban areas. This has been a natural consequence of significant changes in consumer habits driven mainly by connectivity and technological advancements, shifts in work patterns, and the ongoing effects of the COVID-19 pandemic.Is well known that due to connectivity and technological advancements, consumer habits have been greatly affected by the rise of remote work, flexible work arrangements and the gradual success of online shopping. Many companies have adopted hybrid work models, allowing employees to work from home part of the time. As a result, there has been a decrease in demand for traditional office spaces in city centers. The progressive adoption of online shopping (e-commerce) reduced the need for street commercial sq ft and increasing vacancy rates. By mid-2010’s it was already observed that several shopping malls started to experience critically low occupations and some of them were repurposed, transformed, or demolished.Online remote work also contributed more recently and fiercely to decreasing traffic (and decreasing sales) in commercial retail spaces near offices and consequently higher availability and price degradation of commercial retail spaces.Business and Policy concerns have been addressed from several perspectives; however, a formal approach, from and economist perspective, turns out to be relevant to identify and address potential solutions.Structural ChangesThe effects of the changes of consumer habits drive important structural changes for and within the Real Estate industry. Connectivity and technological advancements have enhanced labor productivity regardless of location and synchronization of activities. Nowadays, an increasing share of the economy has turned to be digital (up to 25% in 2021 and growing at 10% annual rate for the US according to the Bureau of Economic Analysis). Digital economy does not require to be produced at the same location and can be asynchronous. It opened a wide range of opportunities for workers to contribute, profit, and improve productivity, in different locations and time zones. It broke several restrictions for employees, providing more convenient labor conditions and improving their living standards, but also harming several Real Estate Businesses’ structural conditions.New habits reduced what economist call “Barriers to Entry” for the Capital-Intensive Real Estate Industry. In the old days, without connectivity and technological advancement such as distributed and cloud computing, Business Owners were forced to claim concurrent presence of workers at a central office location. Nowadays, sq ft of worker’s residence in well-connected but cheaper sub-urban areas, currently compete with sq feet in urban, fancy, state-of the-art, and expensive areas. All what is required is connectivity, what substantially reduced all other locational and functional barriers to entry for the Office Space Real Estate businesses. New flexible, and adaptative business models have started to emerge, mainly in sub-urban areas that literally replace the functionality of the traditional office space model, now obsolete.The fist noticeable impact for the industry is towards the optimal scale of the business unit. In the old days without connectivity and technological advancement such as distributed and cloud computing, Economics of Scale seemed unstoppable. Taller and bigger buildings in locations near transport hubs and other similar buildings, seemed to outperform any other offering. The higher the density of usage per sq ft of land, the more profitable seemed in terms of value and revenue potential. This concept seems to start facing its limits now that occupation faces important challenges. Value is a function of potential or actual revenue, and revenue is a function of occupation and traffic. Now that occupation and traffic have been declining and maintenance costs and taxes (carry cost) remain, value started to be questioned. So nowadays, in the new reality, the optimal scale of the business unit for Office Space seems to be limited regardless of surrounding infrastructure availability.Along with the fall of Barriers to Entry, including the optimal unit scale as one of them, new players may participate in the market with new, innovative, and relevant offerings. Markets in which many firms can enter and exit rapidly are called Contestable Markets. In this sense, Real Estate Office Space Industry has become increasingly contestable and increasingly competitive. Due to the above, sq ft owners will (and have already started to) reduce Price Rigidities. Either by reducing prices, relaxing terms and conditions for clients, or forced to invest in new amenities of facilities to retain or attract clients, sq ft owners of office spaces will be required to adjust prices. Pricing will be increasingly more dependent on competition’s offering, necessarily reducing bargaining power of sq ft owners.With increasing availability of sq ft in the surroundings, new and more sophisticated offering near to labor’s housing, a different pricing structure, and unstable market conditions; price elasticities (occupation sensitivity to price changes) will induce increasing uncertainty for both owner and leasers, affecting contractual length and other contractual terms fundamental to sustain Price Mark-ups and owner’s margins. Uncertainty also means increasing transaction costs what also represent an aditional burden for owner's margins.An increasingly contestable market conduces to Non-Cooperative Behaviors within the industry. With Predatory Pricing as the primary and more natural behavior, sq ft owners will face fierce competition that may lead to other predatory strategies. It is relevant also to understand that Real Estate Industry is highly leveraged under the assumption that Real Estate valuation is always on the rise. We have discussed earlier that this assumption may not be sustainable this time. Market participants facing debt, have high incentives for predatory strategies to comply with their debt repayment requirements. The higher the leverage in the industry, the higher the fierce price competition in the industry.

All along with the above comes the effect of the de-consolidation of the industry. Effects on the Optimal Business Unit Scale, drives to a structural changes within the firms holding this kind of assets. Contestable market erodes Market Power of incumbent firms with out scaled and obsolete business models, holding obsolete assets and facing expensive carry costs.Opportunities and means for resilenceThe effects of the changes of consumer habits force the sq ft owners of Office Space to face challenges from an innovative and creative perspective; however, a formal approach, from and economist perspective, turns out to be relevant to identify and address potential solutions.

In conjunction with the aforementioned challenges, new context provides opportunities to take advantage of (or enhance) Economics of Scope from the capital already deployed. Economics of scope implies that is efficient to produce two or more products utilizing the same production facility.For a Real Estate facility, Economics of Scope means use the facility for two (or more) different purposes, let’s say offices and housing, a mixed-use including office, commercial and residential components. Although is not that simple, and requires additional capital to be deployed to adapt the facilities, it seems to be the logical alternative for survival. It is not the fist time entire zones of cities are repurposed to adapt to new realities. This time the repurposing will tend to be oriented to satisfy the emergent needs of an emergent type of workers. Recent surveys show that social integration seems to be an important driver. It is still speculative but some analysts believe those facilities, if properly re-adapted, may be a catalyst to create new integral vibrant vertical communities, that may achieve integral and profitable full potential usage of massive office buildings.

Another contingent strategy is product differentiation. To regain Market Power at least for a particular niche, sq ft owners will be required to differentiate their product from their competitors. Differentiation refers to the degree to which products or services offered by different firms are perceived as distinct in the eyes of consumers. Greater product differentiation leads to reduced substitutability and increased market power. To achieve this goal, sq ft owners will have to clearly identify what it’s been demanded in their market, by, for instance, enhancing technological infrastructure, upgrading digital amenities, such as high-speed internet and smart home features, providing or enhance recreational areas and features for improved work-life balance; all that can attract remote workers to urban housing. Success is not guaranteed in uncertain market conditions. However, doing nothing is almost a certain guarantee for failure.

If not an integral solution, Non-Linear Pricing may provide a path to search for pricing mark ups. Non-Linear pricing refers to price adaptability according to either client specificities, market conditions, demanded features, etc. An example of this can be auctioning sq ft according to certain conveniences or by charging for unique experiences This strategy demands relaxation of current regulation of the market what requires authorities understanding of current context.Another case of partial solution refers to be Information Asymmetries. In unstable and uncertain market condition information asymmetries provide opportunities for Non-Linear pricing. Rebranding and Marketing emphasizing the advantages of urban living while catering to remote work preferences may attract the right costumers. Under market deconsolidation and transformation, a de-standardization of market offering as well as pricing, will provide opportunities for new mark-up and new price rigidities under certain conditions.In our firm we are ready to provide a professional service attending punctually the efects of Ecnomics of Scale, Ecomics of Scope, Linear and Non-Linear Pricing, Differentaion and Pricing Elasticities for your company to face what is about to happen in the Real Estate Industry.Current Gainers and LosersOffice and Commercial: The shift in consumer habits towards remote work and flexible office arrangements has significantly impacted the commercial and Office Space real estate industry. Traditional long-term office leases are becoming less attractive to businesses as they seek to optimize costs and adapt to changing work patterns. Co-working spaces like WeWork and Regus have seen a surge in demand as businesses opt for flexible office solutions that allow them to scale up or down according to their needs without committing to long-term leases. According to a survey conducted by JLL in 2021, flexible office spaces saw a 24% increase in demand year-on-year. Current new trend: Flexible office

Residential: The changes in office space consumption have also influenced residential real estate trends. As more professionals adopt remote work, there has been a shift in housing preferences towards suburban and rural areas, away from city centers. According to the National Association of Realtors, in 2021, the median sales price of existing homes in suburban areas increased by 11.2%, outpacing the growth in urban areas by 5.7%. In cities like New York and San Francisco, where high-density urban living was once preferred, there has been an exodus to the suburbs due to increased remote work opportunities. This shift has driven up demand and prices for single-family homes in suburban locations.Current Trend: Suburbanization

Industrial: The changes in office space consumption have had ripple effects on the industrial real estate sector. With the rise of e-commerce and the need for efficient last-mile delivery solutions, there has been a surge in demand for warehouse and distribution center spaces. According to a report by CBRE, the demand for last-mile distribution centers grew by 50% in the past two years, and the vacancy rates for these properties have dropped significantly, driving up rents by an average of 7.5%. Amazon's expansion and its emphasis on one-day and same-day delivery have led to a massive demand for strategically located distribution centers near urban centers. This change in consumer habits has forced industrial real estate developers to focus on constructing properties suitable for last-mile delivery logistics. Current Trend: Last Mile DeliveryHospitality: The hospitality sector has been significantly impacted by the changes in consumer habits of office spaces. The decrease in business travel and corporate events has led to shifts in the types of properties and services that are in demand. With fewer corporate travelers, hotels and resorts have been adapting their offerings to attract "bleisure" travelers - those who combine business trips with leisure activities. This adaptation includes providing enhanced amenities and experiences beyond traditional business services. According to a study conducted by Expedia in 2021, 60% of business travelers reported taking bleisure trips, and 87% of them extended their stay for leisure purposes. A well-known hotel in a major business hub noticed a decline in weekday occupancy rates but a surge in weekend stays. To cater to the new consumer habits, they rebranded their business center as a "collaboration lounge" with co-working spaces, and they offered weekend packages with curated local experiences to attract bleisure travelers. Current Trend: Bleisure Travel.Summer 2023